- I think we should first have visibility on the supply of $PRINTS being offered in the OTC. The we can propose a reasonable turnover ratio.

- I would only organize the ask prices so buyers can easily use the airswap links to complete the transactions. To include bid prices could potentially create a chaotic environment with investors trying to “fish” for deals way below “market prices”. Regarding the liquidity provided by the DAO, maybe we could set a price range in which the Finance team would have autonomy to buy $PRINTS respecting the monthly budget. That way we won’t set a price to influence the OTC. It could be a broad range too, like 0.0020-0.0055 ETH/$PRINTS.

Sorry if I’m not understanding correctly but as long as theres an upper bound to the range what would incentivize anyone to ask the min? (ie .002 vs .005)

A floor makes sense, similar to how irl social clubs have a cost of membership I believe we should have some consensus at this point as to what it costs to be a member of FP in dollar terms.

Naturally as we grow along with our collection and treasury this membership value will need to be reevaluated.

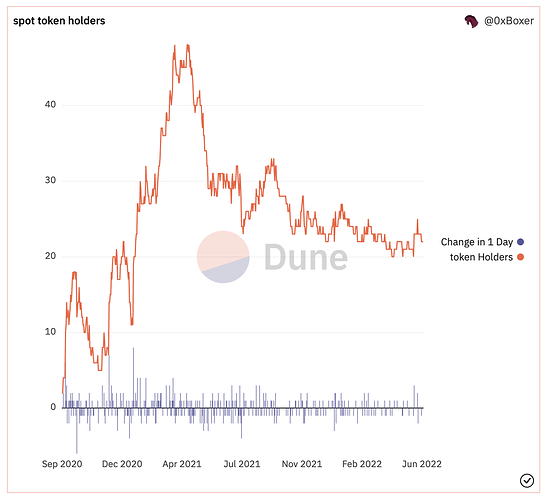

The orderbook hasn’t been updated in some time, at last update

there were over 50k PRINTS with asks.

Roughly skimming discord starting 3 months back it’s pretty close to that still, there looks to be about 40-46k PRINTS being offered, or in total 9 full 5k tier memberships.

I don’t have a very good way to rationalize this, but in my mind I always figured 1 full membership of PRINTS per month, so 5k PRINTS per month could be held for sale from the DAO. That would result, if there were no buying PRINTS on the other side, in about 1% dilution of tokens outstanding per year. But I’m mostly pulling that out of thin air, I don’t have much rationale to back it up.

IMO it should function as a sustainable market making operation. The Finance team should acquire tokens at a price that they could sell at least at the same level in the future. I believe spread/profit should be a KPI in this activity and having recurring losses would make it unsustainable.

The idea of having a range is to avoid setting a specific price. If we set only a floor price we would probably push the token price in that direction.

Would a helpful (and simple) first step just be for me to start keeping track of OTC orders again in a workbook like Proper used to do?

In an effort not to waste time tracking past otc orders right now, could we start by proposing a snapshot to y/n a buyback and determine a purchase range?

I think our problem isn’t so much that we are lacking a managed OTC system, FP wasn’t meant to be liquid or traded. We have a situation where we have members looking to exit, lack of buyers at the moment, and those that are looking to enter are largely priced out.

If we evaluate whats mutually beneficial for the DAO and it’s members, we want improved ease of entry/exit without providing complete liquidity, a method of onboarding that ensures quality of community, decentralization of governance, profitability for the DAO.

The DAOs treasury can easily handle offering periodic buybacks to sustain liquidity for members ease of access and community growth.

If we are screening all members for access at the 1k tier, the DAO should always prefer to buyback governance share and control that access, rather than let prints into open market or to new members via exiting members.

Buying back PRINTS in tranches over 1k and redistributing only to 1k tier new members would offer at minimum 100% community growth. By the DAO purchasing PRINTS specifically for distribution to new 1k tier members it will alleviate concerns of centralization the DAO faces.

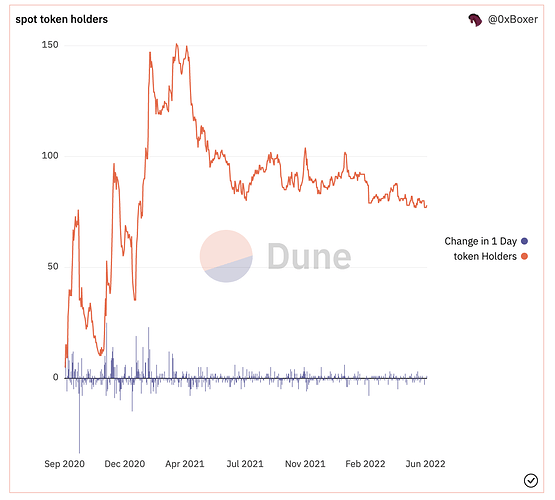

[Assuming the DAO purchased the ~45k PRINTS available from 9 members at 5k tier, with the intention of redistribution to only 1k tier members, the Fingerprints community would gain at minimum 36 new members]

We should determine the amount of PRINTS being offered (as mentioned seems to be ~45k) and the volume of PRINTS the DAO will purchase on a semi-regular basis.

Members would gain regular opportunity for timely exit, the DAO would gain PRINTS for redistribution with the potential to 5x community size (likely at profit…) and the metaverse gains a slightly less centralized, now 80% more accessible DAO.

Once there has been sufficient redistribution we wouldn’t need to sustain buybacks, at that point an OTC desk (hopefully airswap released) could be managed by a member just to streamline matching bid/asks like Proper used to but right now not sure if that will help us.

I’d be on board with this, but I would only really be comfortable with the DAO making a market OTC with a wide spread - eg. buying at a discount to NAV and selling at or above the last round price.

@terence this is great info and feedback.

IMO the changes we’re making at Fingerprints, taking it down the road to decentralization and increasing the importance of PRINTS as a governance token and a way to get exposure to the DAO will actually increase the demand for sub-5k lots.

To get a sense of the size of the internal sell pressure we’re dealing, I would propose a smallish (sub-50 ETH) first tranche of buyback at a low price (at or below NAV). This will not only ease some of the pressure but also give us an adequate view of the market.

Going forward, I would also test out the idea of directing a fixed portion of revenues to buybacks

Considering the current market environment and our goal to maintain a robust balance sheet/treasury, as well as the fact that this is really only a trial run to get a sense for potential sell volumes, I think we should keep the first run quite limited - 10 to 15 ETH, or somewhere in that ballpark. We can always expand the program if we feel it will add significant value.

Current NAV is slightly above 0.0016 as of 6/10/22 - I’d be ok setting pricing for this trial run at 0.0016.

I agree on pricing it at NAV. In order to set the buyback size, maybe we should get a sense of the supply at this price level. Is there any way sellers can privately/anonymously send their orders?

Agreed - I think a good first step, which kind of kills two birds with one stone, is just to start keeping an actively managed OTC workbook again.

This will help manage the OTC activity more efficiently, and it will also allow us to get a sense for demand on both sides of the book which we can use to better inform any potential buyback activity.

I’ll be setting up a workbook and sharing it in the OTC channel sometime today.

Now that we have one month of additional data after setting up the workbook, what do you believe to be the path forward?

Takeaways from the OTC desk so far:

-

The bid/ask spread has tended to be very wide - I believe that has been an obstacle to some trades getting done.

-

Only ~15k to 20k of PRINTS have actually traded in the last month. I’m not sure if that’s a symptom of the wide bid/ask spread, or if it’s representative of the normal trading volumes in this market environment.

-

A fair amount of PRINTS have traded below NAV. I do NOT think that is a symptom of the OTC, as I know some of the sellers and they are well-informed market participants, not forced sellers.

Overall - I don’t think the OTC is functioning as a very efficient venue for trading, so I’d be in favor of a new method.

However - I think we should get a sense from the DAO as to whether liquidity is something that is actually desired. If it is, we should explore new venues; if not, then I think the OTC may just be sufficient.

In relation to the buyback discussion - my preference would be to search for a way to provide real liquidity, rather than do a programmatic buyback. I think buybacks should be reserved for one-off compelling opportunities - not programmatic and regular, particularly at this stage in the DAOs life.

Here’s a potential alternative to a DAO managed OTC desk that I think may have some promise:

I spoke with a company called Size today. They’re a protocol that manages token auctions to facilitate liquidity events. Traditionally, it sounds like they’ve been used mainly to facilitate liquidity for larger sellers - either a treasury selling tokens or a few large holders who want to sell tokens. They set up auctions and then allow buyers to participate in a sealed-bid format, thus facilitating a liquidity event and price discovery.

I asked them if it would be possible to utilize the protocol with a fragmented base of sellers, rather than one or two large sellers. The idea being we could have regular, recurring liquidity auctions for the DAO, where any seller could place their PRINTS into an auction contract, and on the other side buyers would set the price via a series of sealed bids.

This would act as a form of liquidity for DAO members and prospective buyers. It obviously wouldn’t be the same as constant liquidity like on a DEX, but it sounds interesting enough to at least keep pursuing.

Any thoughts?

It could work, can we have a trial period?

Can definitely check, I don’t see why they would be opposed.

One alternative usage by the way would be to use them to have one main auction to find a market clearing price, and then use that price to launch traditional DEX liquidity. Just another option.

My only concern regarding DEX is the need to provide liquidity, I don’t think we should be investing ETH on that at this moment.